Lessons From Your Favorite TV Shows

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

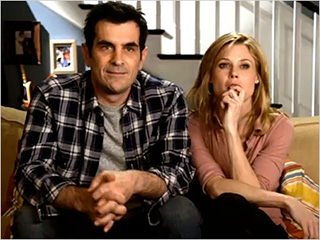

“Modern Family” --- Teach your children about money. If anyone knows that life is full of teachable moments, its Phil and Claire Dunphy. Every episode they’re able to learn from their own circumstances or teach their children something valuable. Look for moments like these in your own life. For example, when strolling through the candy or toy section at a store, teach your kids about why it’s good to avoid impulsive purchases.

“How I Met Your Mother” --- Purchase only what you can afford. Credit cards can be helpful tools for achieving your financial goals when used responsibly. For Lily Aldrin, credit cards were a way... to feed her passion for fashion. She maxed out over 15 credit cards without a second thought, and it eventually put pressure on her marriage and jeopardized her chances of buying a home. As a general rule, you should only purchase items on your credit card if you have the money to pay it off at the end of the month. Lily disregarded this guideline and built up a debt “the size of Mount Waddington,” according to Robin Scherbatsky.

“Breaking Bad” --- Think long-term. A number of goals, including investing and saving for retirement, require a long-term view. If Walter White had taken a long-term view on his career and his startup, Grey Matter Technologies, he could have saved himself from turning to crime. Walt would have had to ignore the short-term ups and downs of the business, but would have eventually found success and satisfaction in achieving his potential. His actions also show us that we should seriously consider the risks and rewards of our options when making life and money decisions. Overall, Walt’s story teaches us to determine how much risk we are willing to face, determine our strategy, and keep our eye on the goal.

“Sex and the City” --- Live within your means. Budgeting can be a difficult task, but it can help us to make sure we can afford our necessary living expenses before making discretionary purchases—like shoes. Carrie Bradshaw didn’t fully understand how unbalanced her priorities were until she faced losing her apartment: “I've spent $40,000 on shoes, and I have no place to live. I will literally be the old woman who lived in her shoes!”

For guidance on establishing a budget, look to TLC’s “Extreme Couponing” or the network’s wedding program “Say Yes to the Dress,” which shows how you can get what you want, even when you’re on a budget.

“Arrested Development” --- Save for the unexpected. “There’s always money in the banana stand.” Although you would be wise to keep your savings in a more secure location, you can learn from the Bluth’s saving skills by starting or adding to your own emergency fund. Unforeseen expenses and disruptive life events can wreck havoc on your finances if you’re not properly prepared.