Independent Wealth Management

Who scrutinizes your investments, designs and tests your retirement and education plan, searches for new investment ideas, patrols insurance agents and mortgage brokers, shows you strategies designed to reduce your investment costs and income taxes, monitors your 401(k), promptly responds to your email, provides one monthly statement, day-to-day net performance across all of your accounts and does all of your paperwork...We do!

Entries in Financial Planning (14)

10 Conversations Before Marriage

A lot goes into a wedding; but a lot more goes into a marriage. When planning your big day, don’t forget to take time to talk with your partner about the realities of life that come after the “I do’s”—especially your finances. The truth is that money-related issues are often the cause of disagreement (and ultimately, arguments) between married couples. By getting on the same financial page now, you may be able to save yourself from certain cash conflicts and feel more secure in your financial future.

A lot goes into a wedding; but a lot more goes into a marriage. When planning your big day, don’t forget to take time to talk with your partner about the realities of life that come after the “I do’s”—especially your finances. The truth is that money-related issues are often the cause of disagreement (and ultimately, arguments) between married couples. By getting on the same financial page now, you may be able to save yourself from certain cash conflicts and feel more secure in your financial future.

Here are 10 conversations you should have before getting hitched:

Past and present debt. It may sound cliché, but you need to know what you are getting yourself into. Discuss credit card debt, student loans, business loans, anything you or your partner are paying off. Then, determine how the debt will be paid going forward—jointly or separately.

You can even take the conversation deeper and explore each other’s past debts as well. Although you may feel this could conjure up negative feelings, knowing how diligent and strategic your spouse was about managing their student debt could be a pleasant surprise and could make you feel more confident with creating your own good debt together—such as a mortgage to purchase a home...

Lessons From Your Favorite TV Shows

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

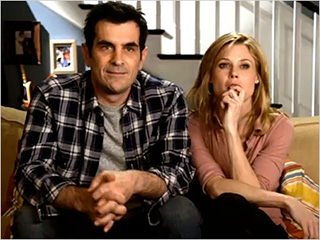

“Modern Family” --- Teach your children about money. If anyone knows that life is full of teachable moments, its Phil and Claire Dunphy. Every episode they’re able to learn from their own circumstances or teach their children something valuable. Look for moments like these in your own life. For example, when strolling through the candy or toy section at a store, teach your kids about why it’s good to avoid impulsive purchases.

“How I Met Your Mother” --- Purchase only what you can afford. Credit cards can be helpful tools for achieving your financial goals when used responsibly. For Lily Aldrin, credit cards were a way...

Are your investment returns real?

Amidst the more obvious lingering effects of a sluggish economy, such as slow job growth, decreasing incomes, low interest rates and shaky consumer confidence, there lurks a more insidious threat which has largely been ignored. Inflation or the prospect of its resurgence has somehow remained under the radar; perhaps because the official measure, the Consumer Price Index (CPI), is still below historical averages, or perhaps because the government has done such a good job in convincing the public that inflation is not a real threat at the moment.

Amidst the more obvious lingering effects of a sluggish economy, such as slow job growth, decreasing incomes, low interest rates and shaky consumer confidence, there lurks a more insidious threat which has largely been ignored. Inflation or the prospect of its resurgence has somehow remained under the radar; perhaps because the official measure, the Consumer Price Index (CPI), is still below historical averages, or perhaps because the government has done such a good job in convincing the public that inflation is not a real threat at the moment.

While declining paychecks and near-zero growth savings accounts are the tangible results of the current economic and fiscal environment, inflation is the ever-present hidden tax. In real terms this creates a critical perception gap between what people see as their “nominal” income, that which they can see in their checking and savings accounts, and their “real” income they can actually use to buy gas, groceries and insurance.

4 Retirement Reality Checks

Living a comfortable retirement means planning for how much you will need now, when you have the ability to put away the money to do so. What is your picture perfect retirement? Are you…

Living a comfortable retirement means planning for how much you will need now, when you have the ability to put away the money to do so. What is your picture perfect retirement? Are you…

• Living on a boat, seeing the world one coast at a time…

• Travelling, seeing all of those places you have imagined over the years…

• Spending time at home with your grandchildren, enjoying friends….

• Starting a business or investing more time in a lifelong hobby.

Today's retirees are doing much more than they used to….and the costs of retirement are also much different. In order to better understand how much in assets you need to accumulate (and earn in company pensions and social security), to live the type of life you want…you should know what your retirement life is really going to be like. What should you be planning for?