Independent Wealth Management

Who scrutinizes your investments, designs and tests your retirement and education plan, searches for new investment ideas, patrols insurance agents and mortgage brokers, shows you strategies designed to reduce your investment costs and income taxes, monitors your 401(k), promptly responds to your email, provides one monthly statement, day-to-day net performance across all of your accounts and does all of your paperwork...We do!

Risk Tolerance and Investment Performance

As anyone would have expected, the extraordinary convergence of extreme stock market volatility, low interest rates, declining home values, diminished retirement savings accounts, and chronic economic sluggishness has taken a severe toll on the American psyche. For many investors, it may have forever altered the way in which risk is perceived and managed. For those who misunderstand their actual tolerance for risk this could result in the long-term underperformance of their portfolios. Understanding your risk tolerance is one of the most important elements of investing; knowing how your risk tolerance affects...

10 Conversations Before Marriage

A lot goes into a wedding; but a lot more goes into a marriage. When planning your big day, don’t forget to take time to talk with your partner about the realities of life that come after the “I do’s”—especially your finances. The truth is that money-related issues are often the cause of disagreement (and ultimately, arguments) between married couples. By getting on the same financial page now, you may be able to save yourself from certain cash conflicts and feel more secure in your financial future.

A lot goes into a wedding; but a lot more goes into a marriage. When planning your big day, don’t forget to take time to talk with your partner about the realities of life that come after the “I do’s”—especially your finances. The truth is that money-related issues are often the cause of disagreement (and ultimately, arguments) between married couples. By getting on the same financial page now, you may be able to save yourself from certain cash conflicts and feel more secure in your financial future.

Here are 10 conversations you should have before getting hitched:

Past and present debt. It may sound cliché, but you need to know what you are getting yourself into. Discuss credit card debt, student loans, business loans, anything you or your partner are paying off. Then, determine how the debt will be paid going forward—jointly or separately.

You can even take the conversation deeper and explore each other’s past debts as well. Although you may feel this could conjure up negative feelings, knowing how diligent and strategic your spouse was about managing their student debt could be a pleasant surprise and could make you feel more confident with creating your own good debt together—such as a mortgage to purchase a home...

Investors, Beware the Herd

If you’ve ever seen it, it’s one of those things you’ll never forget – the mass migration of hundreds of thousands of wildebeest moving across the plains of Africa in search of a fresh feeding area. It’s magnificent to watch. Of course, we know why animals herd together – it’s because there’s safety in numbers. If a wildebeest wanders off by itself, it is more likely to be taken by a predator. But, when traveling with thousands of its compadres, there’s less of a chance that will happen. But, what works well for the wildebeest doesn’t necessarily work well for humans. True, there still may be safety in numbers, but have you ever seen a herd stampeded off a cliff? Unfortunately, that what happens to investors when they join the herd.

If you’ve ever seen it, it’s one of those things you’ll never forget – the mass migration of hundreds of thousands of wildebeest moving across the plains of Africa in search of a fresh feeding area. It’s magnificent to watch. Of course, we know why animals herd together – it’s because there’s safety in numbers. If a wildebeest wanders off by itself, it is more likely to be taken by a predator. But, when traveling with thousands of its compadres, there’s less of a chance that will happen. But, what works well for the wildebeest doesn’t necessarily work well for humans. True, there still may be safety in numbers, but have you ever seen a herd stampeded off a cliff? Unfortunately, that what happens to investors when they join the herd.

Humans naturally want to belong to a community – a group of people with shared cultured and socio-economic norms. But, in doing so, we still prize our individuality and sense of responsibility for our own welfare. Why is it that, in investing, humans are induced into following the herd – whether it is at the top of a market rally or over the cliff in a market crash? The answer may lie in the natural human tendency...

Lessons From Your Favorite TV Shows

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

Television can provide all types of entertainment, but if you watch closely, they can also teach you a number of valuable lessons—including how to save and spend wisely. Consider the financial lessons explored in the following five shows:

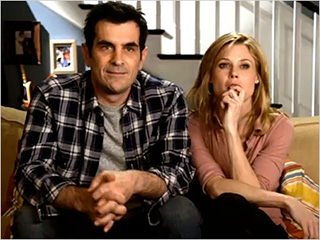

“Modern Family” --- Teach your children about money. If anyone knows that life is full of teachable moments, its Phil and Claire Dunphy. Every episode they’re able to learn from their own circumstances or teach their children something valuable. Look for moments like these in your own life. For example, when strolling through the candy or toy section at a store, teach your kids about why it’s good to avoid impulsive purchases.

“How I Met Your Mother” --- Purchase only what you can afford. Credit cards can be helpful tools for achieving your financial goals when used responsibly. For Lily Aldrin, credit cards were a way...